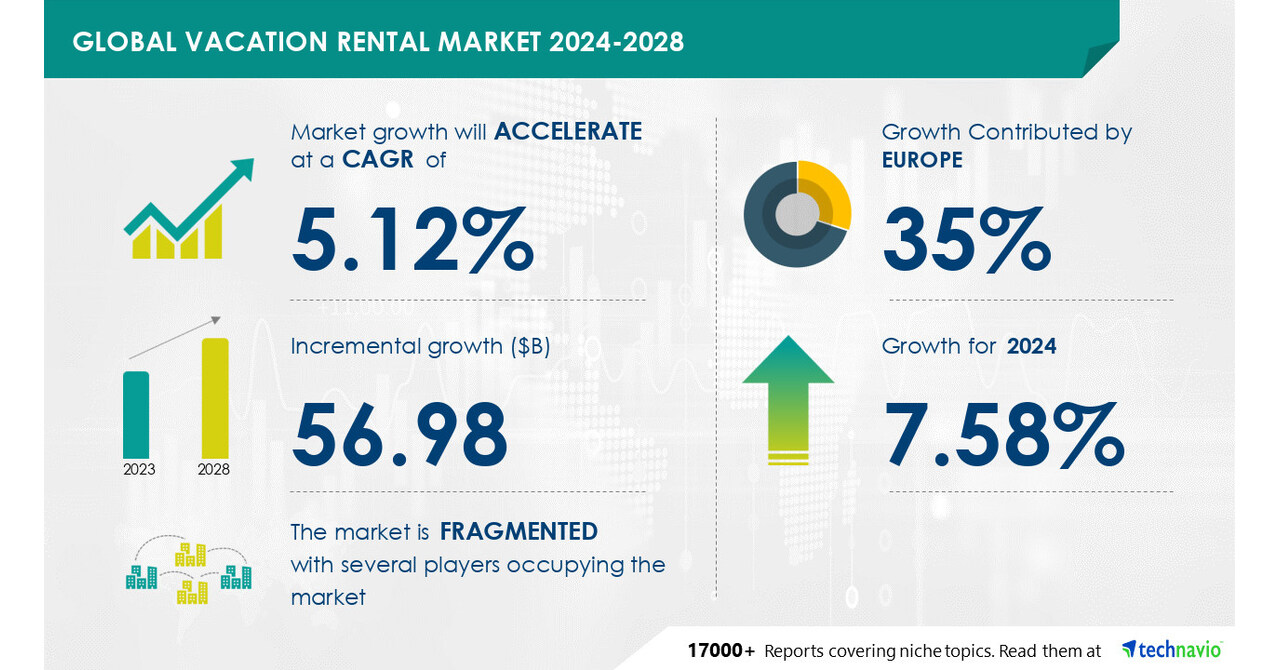

The global vacation property market is experiencing an unprecedented surge as investors increasingly recognize the lucrative potential of second homes and rental properties. In 2024, changing work patterns, growing disposable incomes, and evolving travel preferences have created perfect conditions for this investment boom. This comprehensive guide explores why vacation properties have become the hottest real estate asset class, which locations offer the best returns, and how investors can maximize their profits in this thriving market.

Why Vacation Properties Are the Hottest Investment in 2024

Several key factors are driving the current gold rush in vacation property investments:

-

Remote Work Revolution – With flexible work arrangements becoming permanent, professionals can now work from scenic locations for extended periods.

-

Short-Term Rental Demand – Platforms like Airbnb and VRBO continue to see record bookings, making vacation rentals highly profitable.

-

Inflation Hedge – Tangible real estate assets provide protection against currency devaluation and stock market volatility.

-

Generational Wealth Transfer – Millennials and Gen X are inheriting wealth and investing in experiential assets rather than traditional stocks.

-

Travel Rebound – Post-pandemic wanderlust has created sustained demand for unique vacation experiences worldwide.

A. Top-Performing Vacation Property Markets in 2024

-

Mediterranean Coastline (Spain, Portugal, Italy) – Offering year-round appeal with golden visa programs attracting foreign investors.

-

Caribbean Islands (Bahamas, Turks & Caicos) – Tax advantages and luxury tourism draw high-net-worth buyers.

-

Mountain Retreats (Swiss Alps, Colorado, Canadian Rockies) – Growing demand for ski-in/ski-out properties and nature escapes.

-

Southeast Asia (Bali, Phuket, Vietnam Coast) – Affordable luxury with strong rental yields in emerging markets.

-

U.S. Sunbelt (Florida, Arizona, Texas) – Domestic buyers favor warm-weather destinations with no state income tax.

B. Key Metrics for Evaluating Vacation Property Investments

-

Rental Yield Potential – Calculate projected annual rental income versus property cost.

-

Occupancy Rates – Research local tourism trends and seasonal demand fluctuations.

-

Appreciation History – Analyze 5-10 year price trends in the target area.

-

Carrying Costs – Factor in property taxes, maintenance, HOA fees, and management expenses.

-

Regulatory Environment – Understand local short-term rental laws and ownership restrictions.

C. Smart Strategies for Vacation Property Investors

-

Diversify Your Portfolio – Mix high-end luxury villas with affordable condo units across different regions.

-

Leverage Professional Management – Partner with local property managers to handle bookings and maintenance.

-

Optimize for Dual-Purpose Use – Select properties that serve as both personal retreats and income generators.

-

Target Emerging Destinations – Identify locations before they become mainstream tourist hotspots.

-

Utilize Tax Advantages – Explore depreciation benefits, 1031 exchanges, and foreign investment incentives.

D. Technology Transforming Vacation Property Investments

-

Dynamic Pricing Algorithms – AI tools that adjust rental rates in real-time based on demand.

-

Virtual Property Tours – 3D walkthroughs and drone footage attract international buyers.

-

Blockchain Transactions – Secure cross-border purchases with smart contracts.

-

IoT Home Management – Remote monitoring of security, energy use, and maintenance needs.

Emerging Trends Shaping the Future

-

Co-Ownership Models – Fractional ownership platforms making luxury properties more accessible.

-

Eco-Conscious Developments – Sustainable resorts with carbon-neutral designs gaining premium value.

-

Workation Communities – Purpose-built developments combining co-working spaces with leisure amenities.

-

Generational Travel Homes – Families pooling resources to buy legacy vacation properties.

Conclusion

The vacation property market presents extraordinary opportunities for investors in 2024, combining strong financial returns with lifestyle benefits. By carefully selecting locations, understanding market dynamics, and leveraging modern management tools, investors can build profitable portfolios that appreciate over time while generating substantial passive income. As global travel patterns continue evolving, strategic investments in vacation real estate will remain one of the most rewarding asset classes for years to come.

Tags: vacation homes, rental property investment, Airbnb strategy, real estate market, passive income, luxury retreats, property management, emerging markets, travel trends, wealth building

:format(webp))